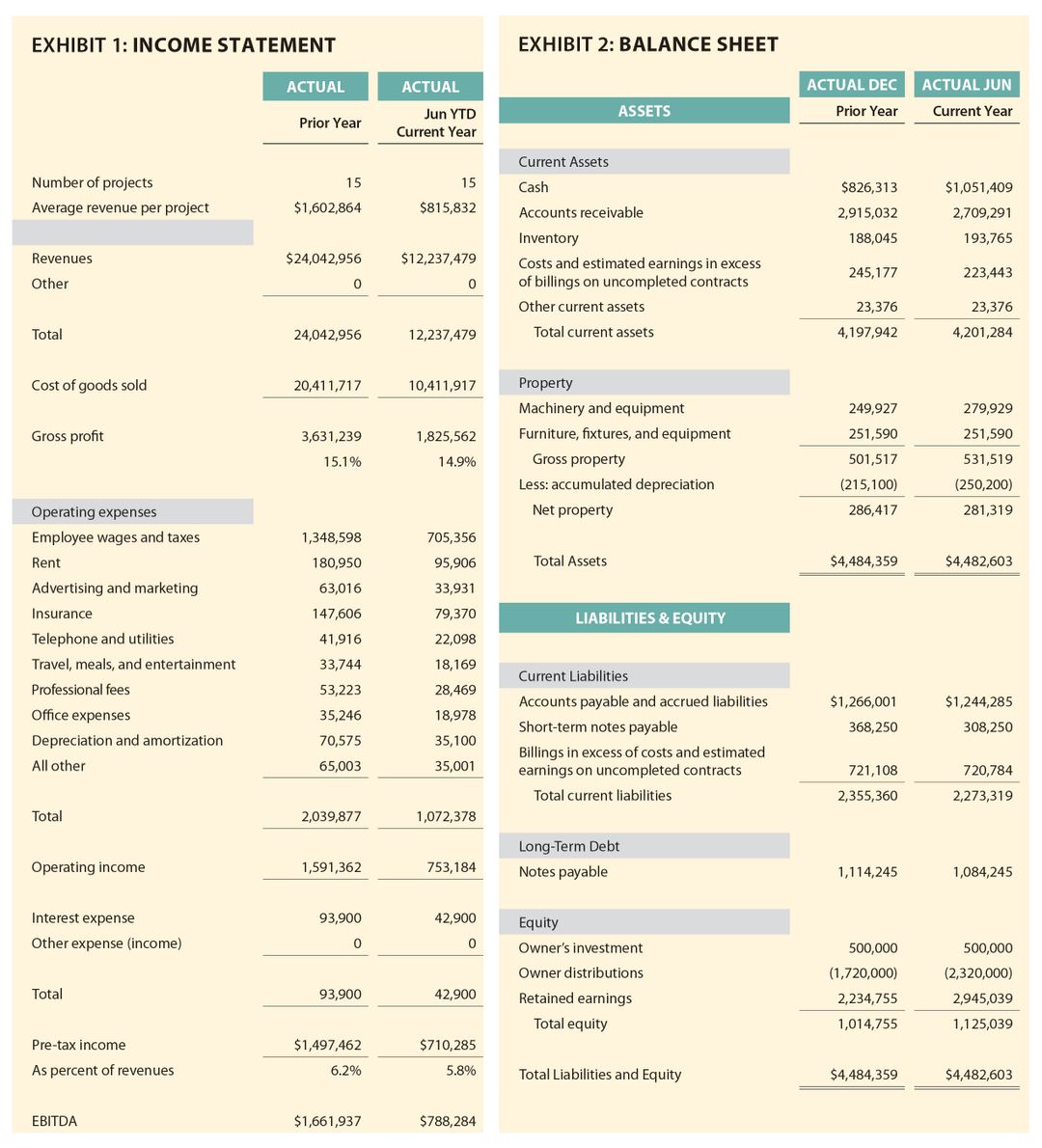

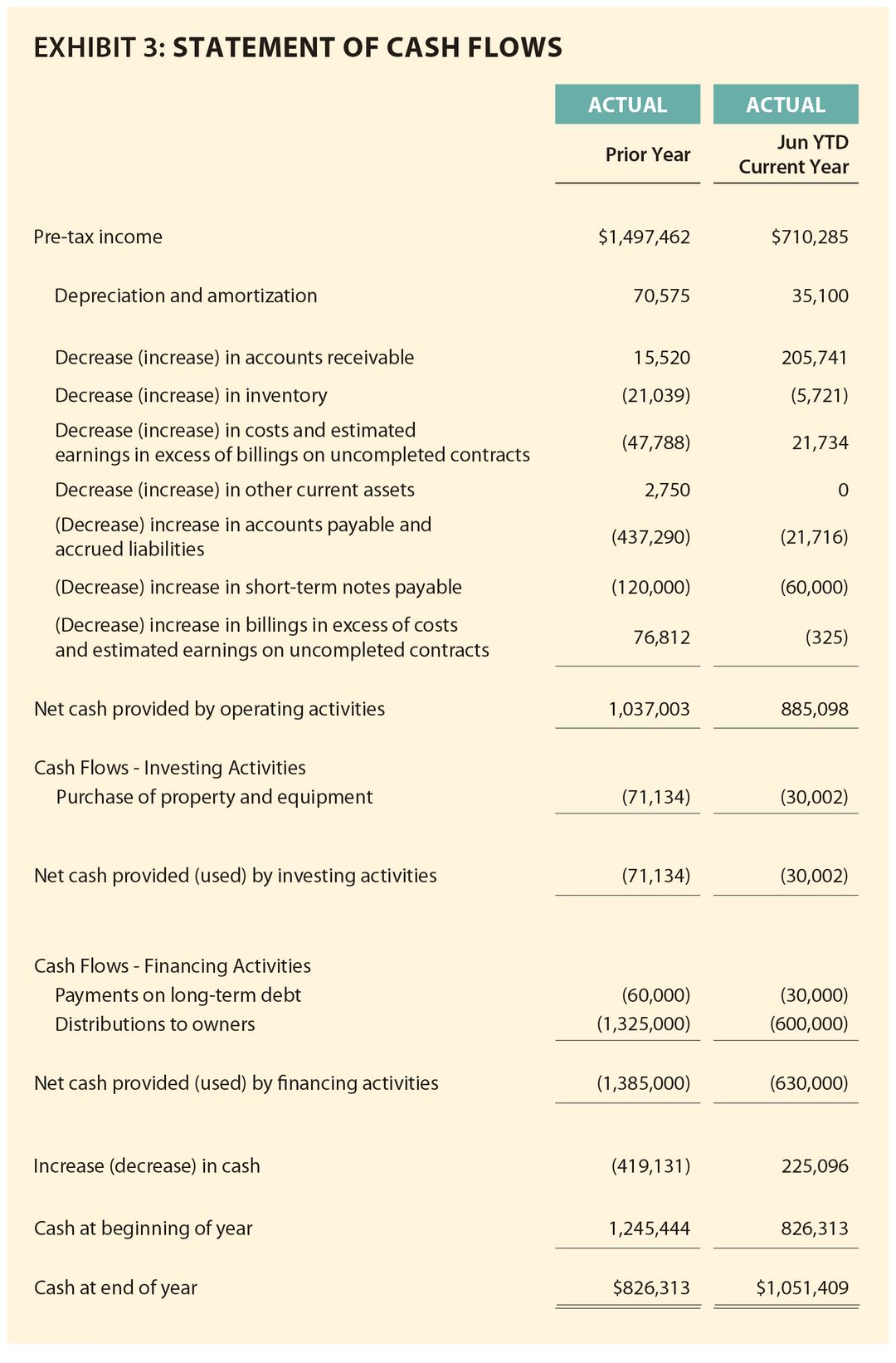

Walk through the process of creating a reliable & repeatable forecast. The previous installment of this article series, which appeared in the May/June 2019 issue, detailed the step-by-step process for planning, creating, and presenting a reliable and repeatable financial forecast. To help you better understand each step and overcome potential obstacles and resistance, this article will walk you through a sample GC’s first time creating a financial forecast.

In this scenario, ABC Construction’s CEO/owner plans to recruit a number of respected and experienced entrepreneurs, executives, and savvy members of the financial community to join his Board of Directors. He wants to take his company to the next level and believes that having people who have “been there and done that” will be critical to his success in growing the company. Current annual revenues are about $25 million and he wants to double that number over the next three years.

One of the tools the CEO and Board of Directors will use to plan and monitor the pace and progress of ABC’s growth strategies is a reliable financial forecast. And, the CEO wants the forecasting process in place before recruiting board members.

In this example, ABC’s CFM and I worked through the process to plan, create, and present the company’s first financial forecast. The goal was to make the process a “top-down” rather than “bottom-up” exercise – one that required very little input or effort from others in the company.

Building the Forecast

Like a construction project, the three distinct phases of building a forecast are Plan, Create, and Present. (For more on these phases, refer to the May/June 2019 issue.)

Since the CFM was a spreadsheet “power user,” we decided to create the financial model in Excel so that it could be updated monthly and would track the company’s existing financial statement format.

Plan

Set the Objectives

The objectives were heavily influenced by the CEO’s desire to create a tool to support a robust financial planning and monitoring process for the Board. The objectives were documented as:

- Implement a reliable financial forecasting/projection process to provide a clear view of likely financial results in order to evaluate various growth plans and strategies.

- Incorporate the forecast into the monthly financial reporting process for the Board.

These two objectives guided the implementation. At the end of the project, we referred back to them to ensure we accomplished the original intent of the forecast.