Today, stagnant productivity and ever-present workforce shortages are driving a renewed interest in prefabricated construction. Building components manufactured in a controlled factory setting reduce project cost, time, site logistics, and waste while also improving labor productivity, safety, quality, and sustainability.

The repetitive nature of prefabrication in a controlled factory setting also allows builders and fabricators to better utilize a lower-skilled and aging workforce. This article explores the financial implications for modular and prefabricated construction and provides actionable guidance for using off-site prefabrication to grow profits and market shares.

Trends in Off-Site Construction

Off-site construction is the fabrication and assembly of building elements at a location other than the construction site and may consist of single and multi-trade assemblies such as pipe racks, headwalls, and bathroom pods to complete volumetric building modules.

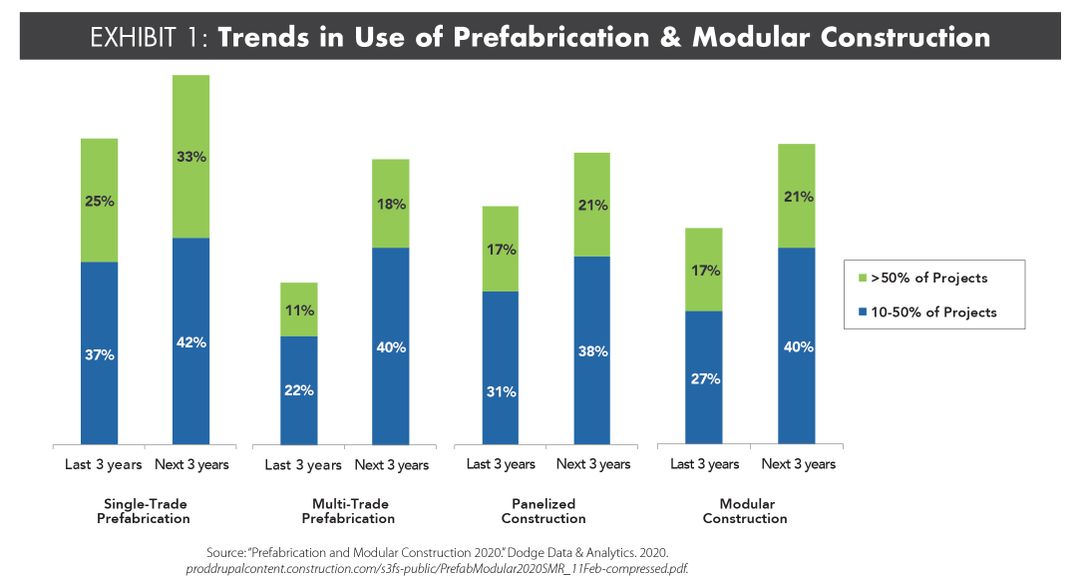

Prefabrication and Modular Construction 2020 by Dodge Data & Analytics surveyed more than 600 architects, engineers, and contractors that have used off-site construction on at least 10% of projects and found that the use of single-trade prefabrication, multi-trade prefabrication, panelized construction, and modular construction is expected to increase significantly over the next three years (Exhibit 1).

Among trade contractors using single and multi-trade prefabrication in this survey, 92% indicated that labor productivity has improved by using off-site construction (Exhibit 2). According to both trade and prime contractors, the cost and schedule performance benefits of off-site construction have increased significantly since 2011.

In fact, roughly one-third of trade contractors and nearly one-half of prime contractors report cost and schedule reductions of more than 10% by using off-site prefabrication and modular construction.

As shown in Exhibit 2, the most dramatic improvements in off-site construction performance since 2011 have been in the client satisfaction and demand, quality, and worker safety areas.

Commercial

According to McGraw-Hill’s 2011 Prefabrication and Modularization: Increasing Productivity in the Construction Industry, more than 800 architects, engineers, and contractors indicated that prefabrication and modularization was being used in nearly half (49%) of all health care projects.

In addition, Dodge Data’s 2020 report anticipated that the use of off-site construction will nearly double over the next three years to 82% of all these projects (Exhibit 3). It also shows that a significant market growth is expected in lodging, multi-family, and higher education off-site construction sectors. Each of these high-growth market sectors are characterized by schedule or occupancy-driven projects where standardized, repetitive building units and mechanical, electrical, and plumbing systems are common.

For these projects, off-site prefabrication and modular construction can proceed simultaneously with onsite construction, thus reducing project overhead and weather delays. Of these, the most significant market for off-site construction growth is expected to be in multi-family housing (condominiums, apartments, student dorms, etc.), which has increased from 23% of projects in 20111 to 71% of projects within the next three years.2

In its 2019 Permanent Modular Construction Report, the Modular Building Institute (MBI) analyzed 17 modular multi-family projects constructed over the past four years (Exhibit 4 on page 52). Cost data obtained on four of these multi-family projects found that the average project value was $22.8 million with the modular portion being roughly 33% of the total project value.3

From approval to occupancy, MBI found that these projects were completed in 241 days on average and generated approximately 6-8 months of added revenue that would not have been possible by using traditional onsite construction.