As we manage the economic impact of the new coronavirus (COVID-19), it is important to have a strategy in place. Implementing change strategies at the appropriate times can be particularly critical when contemplating diversification into a new market, as well as managing fixed assets, personnel, and liquidity levels. As we have recently found, political policy plays a significant part in many of those decisions.

This article examines how fiscal policy has been used for the construction industry in the past and provides some strategies to help prepare for the impacts of economic change. It also presents construction industry trends for the heavy/highway sector using historical data from CFMA’s Construction Financial Benchmarker.

Fiscal Policy as an Economic Strategy

Fiscal policy is used as an economic strategy to stimulate activity, particularly in the construction sector.1 Due to the spending required in order to stimulate activity, infrastructure or heavy/highway construction is often considered a more stable sector.2

Also, fiscal policy must be implemented immediately in order to experience the intended economic benefits,3 whereas a delay may result in unintended trade deficits, extended unemployment, and inflation. With this economic strategy, state demands are artificially created, and nondomestic suppliers of raw materials may be the beneficiaries rather than the domestic suppliers.

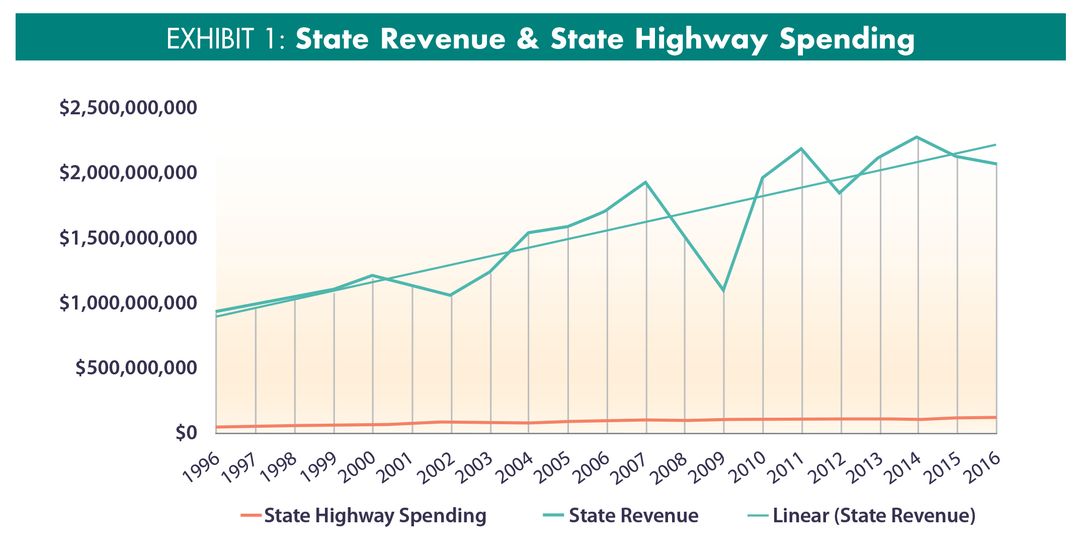

The U.S. Census Bureau’s Annual Survey of State and Local Government Finances4 provides a summary of each state’s revenue and spending from 1996 to 2016, inclusive of the specific expense category of highways (infrastructure and development).

To understand the spending behavior of states during economic climates, the revenue and highway spending for all 50 states has been aggregated and tabulated by year. The ratio of highway spending to state revenue has been calculated from the aggregate data. Exhibit 1 shows the state revenue vs. the state spending on highways as an expense category.

From 1996-2016, the state revenue levels have fluctuated and, in some years, quite dramatically. The large dips in state revenues coincide with the economic recessions in 2000-02 and 2007-09. However, despite the declining years during these recessions, the trend line calculated over the 30-year period shows overall economic growth.

Meanwhile, state highway spending has been very consistent from year to year regardless of a recession or the growth in state revenues. The percentage of state revenue on highway spending in Exhibit 2 shows that the ratio of state spending on highways during recession periods increases dramatically. More accurately though, state spending measured in U.S. dollars for highways has actually been maintained at relatively the same level regardless of decreased state resources as seen in 2000, 2001, 2008, and 2009.

The application of fiscal policy by state governments, at least in consideration of this expense category, can historically be better described as a maintenance rather than a sharp increase in spending as might be assumed. This is consistent with research on how many incumbents are inclined to shift economic strategy from short-term fiscal policy to austerity (a measure used to reduce government budget deficits) in the long term.5

Based on state administrative priorities, other expense categories may be impacted by short-term fiscal policy. Here, we are examining the relationship between state spending on highways as the expense category and the financial implications to the construction industry.